GAMLEHULT ガムレフルト

(税込) 送料込み

商品の説明

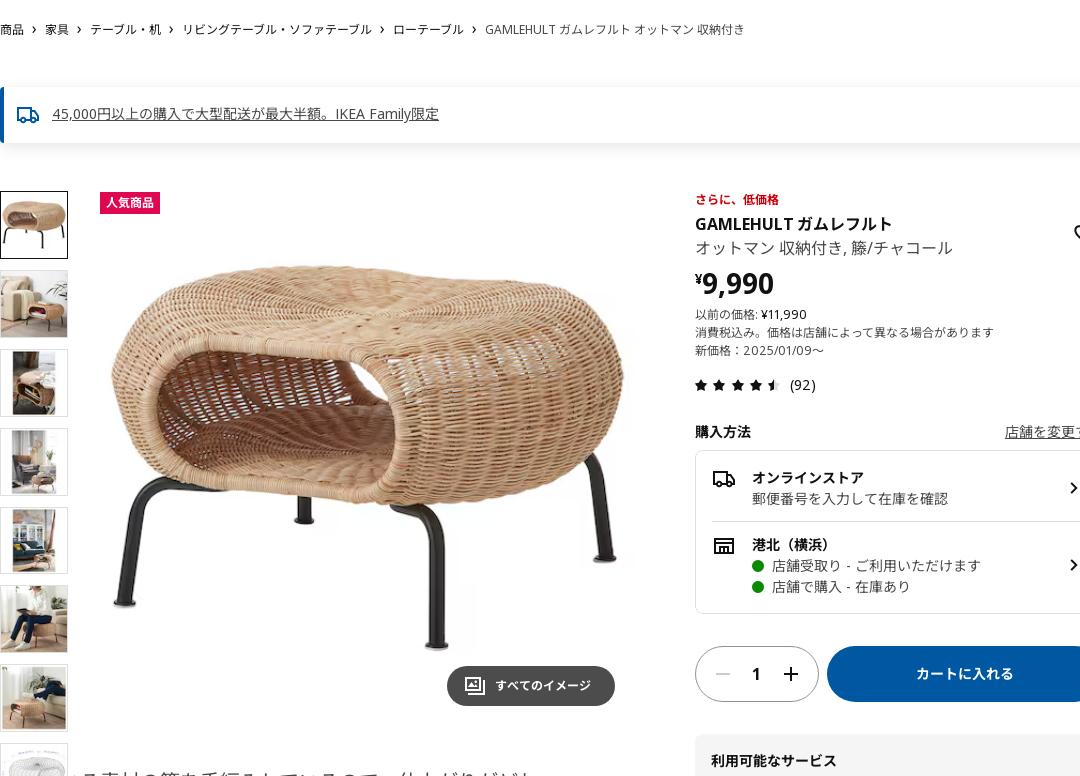

GAMLEHULT ガムレフルト

新品未使用

生きている素材の籐を手編みしているので、仕上がりがどれも少しずつ異なります。フットスツールや予備のシーティング、サイドテーブルに使えて、シート下には隠れた収納もあります。手軽に家の中に自然を取り入れられます

熟練した職人による手編みのフットスツール。一つひとつ仕上がりが異なります

天然素材の籐を使用。使い込むほどに風合いが増します

軽いので持ち運びが簡単です

脚をネジで固定するだけなので、組み立てが簡単です

高さ: 36 cm

直径: 62 cm

床から家具の底面までの高さ: 14 cm商品の情報

| カテゴリー | 家具・インテリア > 机・テーブル > その他 |

|---|---|

| ブランド | イケア |

| 商品の状態 | 新品、未使用 |

GAMLEHULT ガムレフルト オットマン 収納付き, 籐, チャコール - IKEA

GAMLEHULT ガムレフルト オットマン 収納付き, 籐, チャコール - IKEA

GAMLEHULT ガムレフルト オットマン 収納付き, 籐, チャコール - IKEA

GAMLEHULT ガムレフルト オットマン 収納付き, 籐, チャコール - IKEA

GAMLEHULT ガムレフルト オットマン 収納付き, 籐, チャコール - IKEA

最新入荷 IKEA GAMLEHULT ガムレフルト オットマン テーブル

GAMLEHULT ガムレフルト オットマン 収納付き, 籐, チャコール - IKEA

GAMLEHULT ガムレフルト オットマン 収納付き, 籐, チャコール - IKEA

GAMLEHULT ガムレフルト ✖️2 - オットマン・スツール

GAMLEHULT ガムレフルト - メルカリ

BKFチェアとオットマンGAMLEHULT ガムレフルトのある部屋 | hiwahiwa 生活

GAMLEHULT ガムレフルト *一個 - オットマン・スツール

GAMLEHULT ガムレフルト - その他

ガムレフルトのインテリア実例 | RoomClip(ルームクリップ)

IKEA GAMLEHULT ガムレフルト オットマン スツール テーブル

オットマン/籐/GAMLEHULT ガムレフルト/使用感有

![IKEA/イケア/通販]GAMLEHULT ガムレフルト オットマン 収納付き, 籐](https://room.r10s.jp/d/strg/ctrl/22/c50b423ec3371d897df3c3740b82418445cd9e5b.06.9.22.3.jpg)

IKEA/イケア/通販]GAMLEHULT ガムレフルト オットマン 収納付き, 籐

GAMLEHULT ガムレフルト オットマン 収納付き, 籐, チャコール - IKEA

gamlehult ikea | スツール, イケア, 猫

オットマン IKEA/GAMLEHULT ガムレフルト 収納付き 籐-

新品】IKEA GAMLEHULT ガムレフルト オットマン - サイドテーブル

オンライン激安 専用ももさん!IKEA GAMLEHULT ガムレフルト オットマン

2022 IKEA 【GAMLEHULT ガムレフルト】オットマン | nordvpn

IKEA GAMLEHULT ガムレフルト オットマン 収納付き 籐 - スツール

ガムレフルトの中古が安い!激安で譲ります・無料であげます|ジモティー

IKEA GAMLEHULT ガムレフルト オットマン スツール サイドテーブル-

IKEA - GAMLEHULTガムレフルト オットマン 収納付きの通販 by はじめ

GAMLEHULT ガムレフルト-

オットマン/籐/GAMLEHULT ガムレフルト/使用感有

IKEA】GAMLEHULT/ガムレフルト オットマン 収納付き イケア オットマン

IKEA イケア GAMLEHULT ガムレフルト オットマン スツール

大特価 IKEA GAMLEHULT ガムレフルト オットマン スツール テーブル

2024年最新】ガムレフルトの人気アイテム - メルカリ

最新入荷 IKEA GAMLEHULT ガムレフルト オットマン テーブル

IKEA GAMLEHULT ガムレフルト オットマン スツール サイドテーブル-

オットマン/籐/GAMLEHULT ガムレフルト/使用感有

IKEA GAMLEHULT ガムレフルト|Yahoo!フリマ(旧PayPayフリマ)

GAMLEHULT ガムレフルト *一個 最新作の - オットマン・スツール

楽天市場】【あす楽】IKEA イケア オットマン 収納付き 籐 チャコール

オットマン/籐/GAMLEHULT ガムレフルト/使用感有

商品の情報

メルカリ安心への取り組み

お金は事務局に支払われ、評価後に振り込まれます

出品者

スピード発送

この出品者は平均24時間以内に発送しています